goir/iStock via Getty Images

Where Food Comes From (NASDAQ:WFCF) is an auditor for the food supply chain that helps companies certify to quality standards. Their main line of business is related to cattle ranchers, but they are expanding into organic products, animal care, and food manufacturing facilities.

The company operates in an interesting industry with great unit economics, and I believe they have a good strategy for growth. It has been growing revenues and profits consistently, has no debt, and is managed by its founders and largest shareholders.

Despite all these interesting characteristics, the company trades at a multiple to earnings and FCF that is too high, in my opinion. The company's current valuation requires significant growth ahead. The company's road to growth is not a straight line. It has many competitors, some of which are much larger, while others operate on a non-profit basis.

Note: Unless otherwise stated, all information has been obtained from WFCF's filings with the SEC.

Business description

Food supply chain auditor: WFCF helps its clients achieve certifications for the products they sell. These certifications include source and age for cattle, organic processes for vegetables, FDA quality standards for manufacturing facilities, and sourcing for retailers. In total, WFCF helps its clients with almost 30 different certifications.

Experience with cattle: Although the company does not disclose the percentage of revenue generated by its industries, I believe a significant portion comes from cattle ranchers.

Reasons include that it used the name IMI Global, which is now a subsidiary, before changing its name. This subsidiary is mostly dedicated to certifications for ranchers. It also shows more employees on its webpage compared to the rest of the subsidiaries.

Further, the company's founders have occupied prominent positions in the meat industry. For example, the company's President and COO was the Chairman of the U.S. Meat Export Federation between 2015 and 2016.

Finally, in the Process Verified Program service providers list published by the FDA (a list of verification services for cattle ranchers), IMI Global services are listed on a separate page instead of in the table like other providers because the company has so many services.

Great industry economics: Certification has interesting economics. For example, according to IMI Global, the cost of certifying a cattle head's age and source can be as low as $3.5, while the premiums paid on the market can reach $10 per head. For verified natural beef, the certification costs $4.5/head for big operations, but premiums can reach $56/head (of course, including higher production costs).

Usually, when a component (like a certification) is critical for a business but represents a small portion of total costs, it puts the component's provider in a good bargaining position. The rancher will not haggle on the certification price that much if it represents 10% of the cost but is an essential key to obtaining 100% of revenue upside. Most of the time, certification is mandatory for entering specific markets, particularly in food exporting.

Further, the process can be automated for the most part and requires a small structure with good operating leverage. As of FY21, WFCF had 80 full-time employees serving 15 thousand clients.

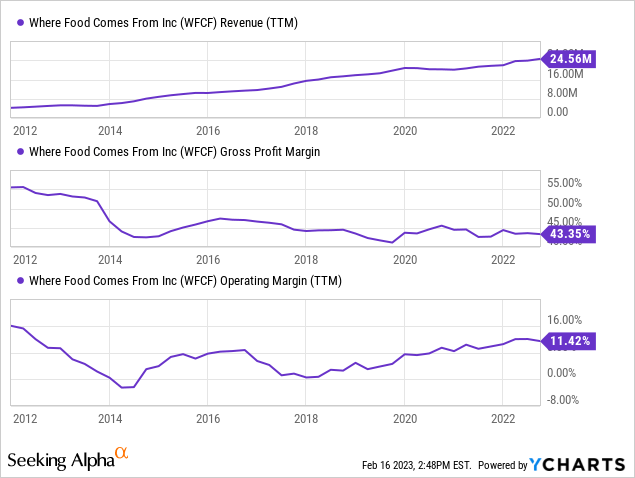

A growth strategy that works: The company has grown revenues and profits steadily while keeping its margins healthy.

The company has grown through two strategies.

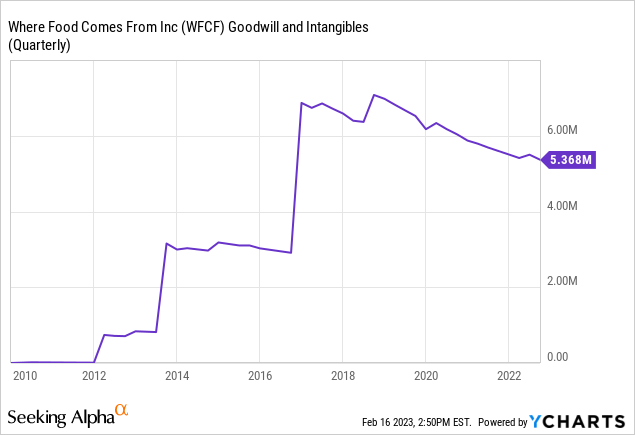

First, it has acquired ten companies at relatively small (not necessarily low) prices, which has allowed it to expand to other markets, leveraging its structure. The company's goodwill and intangibles show that it has not significantly overpaid for these businesses, even though they are asset-light and should have recorded intangibles.

Second, and this is speculative, given that the company does not disclose it, I believe it charges a low entry price to attract the client to win the most profitable recurrent business. For example, IMI Global charges no facility audit costs but a recurrent cost per head certified. Another example is WFCFO, a subsidiary that works with organic food certifications. On its price list for the Paleo Diet certification, the company offers a small price of $1,250 for registering up to 5 products, leaving the ongoing facility auditing cost up for quoting. The same pricing scheme is used for USDA Organic certifications.

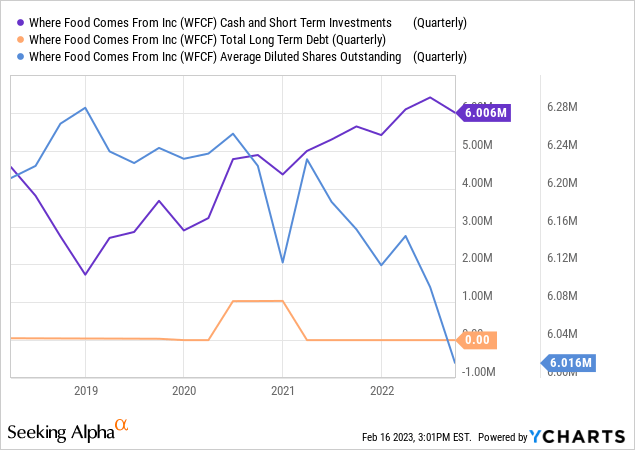

Strong balance sheet: WFCF has no debt and has $6 million in cash reserves. The company has also repurchased shares for the past two years, reducing the share count by 5%.

Managers are owners and founders: The Saunders family, founders of the company, occupy the most important managerial positions. John Saunders is CEO and Chairman of the Board, while his wife, Leann Saunders, is COO and President. According to the company's proxy statement for FY21, they own 28.4% of the stock, while another two members of the Board own 10% each, meaning that insiders own more than 50% of the company. I believe manager-owner is the best type of managerial structure.

Valuation

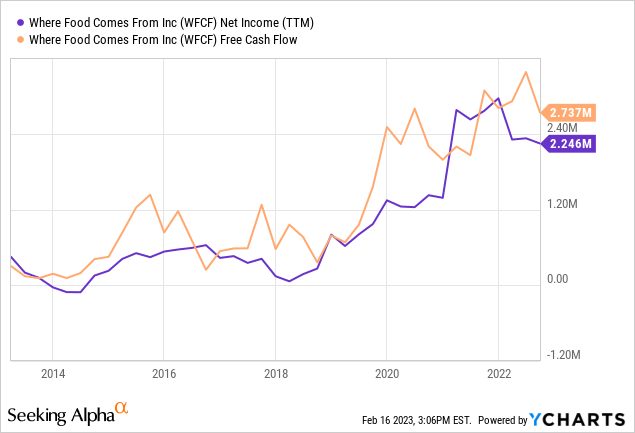

Multiples: The main problem with WFCF is the stock price. The company currently trades at a market cap of $82 million. Still, it generates less than $3 million in net income and a little more in FCF, given that it amortizes acquired intangibles but has no corresponding CAPEX expenses.

This implies a multiple to earnings and FCF above 30x. The problem with such a high multiple to earnings is that the investor has to be certain that growth will continue. Since FY18, the company has grown operating income at a CAGR of 21%, but can this continue?

How much growth?: There is no simple formula for comparing growth with current yields, but we can use some numerical examples.

Company A trades at $100 million and generates $10 million in net income (P/E ratio of 10x). Company B also trades at $100 million but generates only $3.3 million in net income (P/E ratio of 30x, just like WFCF). Further, we consider that Company B will grow faster than Company A for some time (growth differential period). After that growth differential period, both companies will sell at ten times their then-current earnings.

How many years of growth, at what rate, are behind a P/E ratio of 30x compared to one of 10x? For both investments to return the same, Company B has to grow 10 percentage points more than Company A for fifteen years; or 20 percentage points more than Company A for ten years.

Therefore, for WFCF to return the same as a company currently selling at a P/E of 10x, it should grow 20 pp. faster for almost ten years. That is a very hard assumption to make.

If WFCF stock traded at a P/E ratio of 20x, the growth assumptions would be lighter. That is, five years growing 20 pp. faster would suffice, or ten years growing 10 pp. faster.

Not the only competitor: Other companies operate in the same segment as WFCF. Some are much bigger, and many are non for profit. For example, NSF International is a not-for-profit with revenues of $123 million in 2020. SCS Global Services, a for-profit, has revenues of $40 million. Finally, giants like SGS have billions in revenue.

These companies do not concentrate only on food certification but compete in these segments. Further, there are smaller, more local competitors, for example, the sixteen listed for cattle in the USDA Process Verification Program providers list.

Further, in the cattle segment, packers can run their PVP programs without their ranchers having the cattle pre-certified at the source.

I do not see a moat: Unfortunately, I do not see how WFCF could generate a moat in this market, given that they do not own the certifications they offer. They are only auditors.

True, some certifications (like USDA PVP) have compliance requirements that could become a barrier to entry, but only to super-small competitors. WFCF offers many services that its competitors don't, but they could also catch up.

I believe WFCF's market is growing because certification is a recent trend. Still, it will eventually transition to maturity (beef production and exports grow below the economy), and then competition will eat margins.

Conclusions

I like many things about WFCF: it operates in a growing market with interesting customer-power characteristics, it has shown growth while protecting profitability, it is owner-managed, and it has a strong balance sheet.

Unfortunately, WFCF's stock price is too demanding regarding future profitability growth in terms of rates and length of the growth period. I do not believe WFCF can sustain those growth figures for so long, given that there are bigger competitors in the market, some of which are not-for-profit, and the company does not have a moat.

For that reason, I prefer to wait for more attractive entry prices before considering WFCF.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

"company" - Google News

March 05, 2023 at 11:52AM

https://ift.tt/QLVGA9x

Where Food Comes From: A Great Company Trading At Expensive Prices (NASDAQ:WFCF) - Seeking Alpha

"company" - Google News

https://ift.tt/2HB6XCR

https://ift.tt/aQ2sW8g

Bagikan Berita Ini

0 Response to "Where Food Comes From: A Great Company Trading At Expensive Prices (NASDAQ:WFCF) - Seeking Alpha"

Post a Comment